The 8 ½ by 11-inch format

of The

DVD & Blu-ray Release Report (published as a pdf file) doesn’t lend

itself to graphs with long views. You

get to see the “trees” each week (two year snap-shots) and not the

“forest.” Hence this special edition,

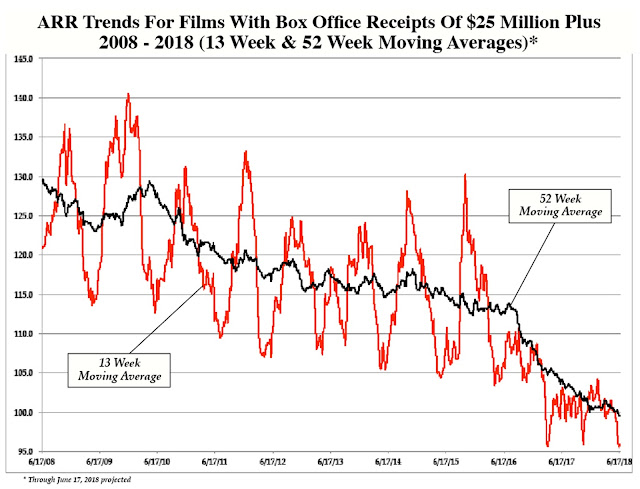

which presents a ten-year view of ARR trends … and it is enlightening.

Forty-eight times per

year, on a weekly basis, The DVD & Blu-ray Release Report

is published, with this week’s up coming edition being No. 1,102. So, we’ve been doing this for sometime now,

but history is about to be made with the 52-week ARR average moving to under

100 days. This will happen on June 12.

That sounds ominous … the

Wolf-Biederman comet will strike the earth on June 12 and life as we know it

will come to an end!

OK, OK, maybe not serious,

but certainly worth a discussion.

First, a little set-up

(the methodology) as to exactly what “history” is about to be made on June 12 …

and more importantly why it might just be a red line for some entertainment

industry players.

Each week in The

DVD & Blu-ray Release Report there are charts and graphs covering

release configurations (types of, count, by year, etc.), plus there is a weekly

survey of what has just been announced and what has just hit the streets in

terms of new theatrical releases. This

segment of the home entertainment packaged media arena, even though “New

Theatrical” accounts for only five percent of all DVD and Blu-ray SKUs

released, is important as these new theatrical arrivals, especially hit

theatrical films, drive the market.

Coverage of “New

Theatrical” is lumped into two groups.

Those films with a box office take of $10 to $25 million and those with

domestic box office grosses in excess of $25 million (the key to the industry). There is a separate chart published each week

for these two classes of film releases as to what is in the pipeline.

One other point, “New

Theatrical” is defined as films released from 1997 on. 1997 wasn’t a random year picked out of a

hat, it was the launch year of the DVD format, so the measurement of how

quickly a film moves from its theatrical rollout to its subsequent release on

DVD — the “window” — seemed like an important statistic to track.

We even gave this measurement

a fancy name, as “window” didn’t seem all that snazzy. After thinking about it for a while, Asset —

which is what new theatrical releases really are — and Rollover Rate (speed to

market) were combined and shorthanded to simply ARR.

Each time there is an editorial write-up on

a new theatrical release in the report, there is always a reference to this

number … such as: “The ARR works out to 95 days … etc., etc.”

It is a quick and easy

way to measure the “window” between a film’s theatrical opening and its

subsequent move to the home entertainment marketplace.

Since 1997, a weekly file

has been maintained and updated tracking all new theatrical releases. Once a

film — regardless of the box office gross — is announced for DVD, Blu-ray or 4K

Ultra HD release, the street date is entered and the ARR is automatically calculated.

Plucked from this

database are those films with a domestic box office take of $25 million or

more. To fall into that group and

generate that level of ticket sales, a film must have three things going for

it. These include a national release with

sufficent screens to generate traffic, a P&A campaign to create awareness

and enough consumer acceptance (often word of mouth) to keep the film in

theatres long enough to generate a critical mass.

If a film under-performs

during the first weekend, exhibitors are quick to move it down the hall and

into smaller multiplex screens during the second week … and then gone.

This is one reason why The

DVD & Blu-ray Release Report monitors the next level down — $10 to

$25 million performers — as they often have decent theatrical breaks with a

campaign behind them, but fail to achieve consumer acceptance.

Each week there are two

new up dated charts produced featuring the top tier of new theatrical

releases. One monitors studio

performance (a ranking of how fast they are moving their hit films) and the

second shows the overall ARR trend, which is presented as 13 week (quarterly)

and 52 week (annual) moving averages.

This brings us to the

potential “red line” news. Sure, it

sounds like we have done a terrific job of burying the lede, but without an

understanding of the methodology employed, the news itself might not have any

contextual meaning.

With two new home

entertainment release announcements this week, one for Death Wish, by 20th

Century-Fox Home Entertainment, and the other from Walt Disney Studios Home

Entertainment, A Wrinkle in Time — with the same street date of June 5 (ARR of

95 and 88 days respectively) — the annual ARR moving average the following week

(street date Tuesday, June 12) will pierce the 100-day mark for the first time

in the history of home entertainment package media.

The larger graph of these

two ARR trend lines — 13 weeks and 52 weeks — clearly shows the trends in a

more visual way than can be accommodated in the weekly edition of the report.

In mid-December the

annual average came right down to the line at an ARR of 100.1 days and then

bounced off it. It seemed that the

studios — collectively — recognized that maybe, just maybe, that’s an

equilibrium that should not be breeched and held the line for going on six

months … until this week’s announcements, which, not in and of themselves

individually, push the ARR average below the 100-day mark.

The first thing that you

will notice is the wild 13-week moving average swings. Summer theatrical hits opening in June, July

and August have been traditionally held back until the retail Christmas-selling

season. There is no reason to rush a

monster to market when unit sales can be maximized during the Thanksgiving to

Christmas shopping window. That is

rational and reasoned economic behavior.

The other end of the

spectrum are Thanksgiving and Christmas blockbusters, plus Q1 new theatrical

releases, which are pushed as quickly to market as can be to have them

available at retail before Memorial Day and the official kickoff of summer.

These wild swings are

clearly visible in the “forest” chart, but don’t have the same impact with the

weekly “tree” chart.

The 52-week moving

average shows a steady drop from the summer of 2010 until post-Labor Day period

of 2016. Roughly speaking, two weeks

were shaved — systematically — off of the ARR moving average during this

extended period.

A dramatic change

occurred in the fall of 2016, which has resulted in another two weeks being cut

from the ARR average in just 18 months — this is an obvious sea-change in the

trend.

As mentioned, the ARR

came right down to the 100-day mark in mid-December of 2017 and then held …

that is, until June 12.

It is not the purpose of The

DVD & Blu-ray Release Report to make a judgment on whether this is

a good thing or a bad thing … or perhaps, nothing at all. But it does appear to be a trend that will

likely have an effect on the marketplace, either now, or very soon.

How much heat can

exhibitors stand before they crack? And it is not just exhibitors who feel the

flames of digital … the studios have a home entertainment packaged media

business that is also being pressured by these ever-shortening release

windows.

100 days? Is that the “red line?” 95, 88 … 81?

There is a tipping point.

Right now exhibitors are

flush with the arrival of new pre-summer and summer blockbusters, so like the

frog in the pot being slowly brought to a boil, they may not take notice of the

potential peril that they are faced with.

Theatrical exhibition has

been the traditional economic model for launching film productions. A studio ponies up production and P&A

funds, makes a big deal (or little deal) about the stars and the story and the

director … or the significance of a film.

They find the PR hook and run with it.

And then everything flows out from there.

As my distribution

brethren were quick to point out when I was running home entertainment

marketing at Metro-Goldwyn-Mayer, “home video is an ancillary market … without

us, you have no business.”

Is there a number that is

too quick? Or, does the ARR annual

trend line simply point to the way things are and exhibitors will have to

adjust to each new reality? Perhaps a

day will come — and maybe sooner than anyone expects — when someone like, oh say, Adam

Aron, the president and CEO of AMC Theatres, calls together MPAA studio members

and utters the same words, “without us, you have no business.” What will be their collective reply? “Seen the trend lines, lately?”