The bump didn’t take as the projected number of new theatrical releases for 2023 fell back to 520 (down from 542 two weeks ago). This is a count that has become fairly consistent as the year unfolds … a range of 501 to 523 keeps popping up since early March.

There’s nothing magical about it. There are so many weeks in a year, so many theatrical venues and so many seats that can be filled on the opening Friday and Saturday nights. The pattern traces out over and over again from one year to the next (pandemic years of 2019-2021 removed from consideration).

The projected top box scores for 2023 ($25 million plus; $100 million plus) dropped from 67 to 64 as only Paramount’s Transformers: Rise of the Beasts was able to draw enough ticket sales during its opening stanza to exceed the $25 million mark (an opening of $61 million).

It should be noted that Disney’s release of director Rob Savage’s The Boogeyman will also exceed the $25 million box office mark … it will take just one more week to get there.

On the transition front — from domestic theatrical playdates to the home entertainment packaged media arena — director George Tillman Jr.’s biopic, Big George Foreman: The Miraculous Story of the Once and Future Heavyweight Champion of the World will be available as both DVD and Blu-ray editions on June 27 (Sony Pictures), Writer/Director Ari Aster’s Beau is Afraid has both DVD and Blu-ray/DVD Combo Pack product offerings heading home on July 11 (Lionsgate Home Entertainment) and writer/director Jim Strouse’s Love Again will street on July 18 as DVD and Blu-ray editions (also from Sony Pictures).

Netflix dropped director Sam Hargrave’s $70 million production of Extraction 2, starring Chris Hemsworth, Golshifteh Farahani (reprising her role as Nik Kahn), and Adam Bessa (also back as Yaz Kahn) on June 16 and it was immediately released by at least two different “helper”/”void-filler” sites as Blu-ray editions on the same day.

A couple of observations, nothing more — Netflix has their way of doing things — and who are we to second-guess.

You bypass, in the prime summer theatrical season, a nationwide theatrical launch of a $70 million action flick, with a bankable box office star, and go directly to streaming … does that really maximize shareholder return on investment?

Does it help boost the fortunes of the theatrical marketplace, which is still in recovery mode after the ill-conceived Covid lockdowns?

You also skip another stop along the way, where — as a rights’ owner — you control the revenue stream. This would be the individual sales of DVD, Blu-ray and 4K Ultra HD copies. Does bypassing this sales source maximize shareholder return on investment?

Just doing dummy math — nothing official, just guessing — let’s say the film pulled in $100 million in domestic ticket sales during its summer run, that means Netflix burned roughly — give or take — $50 million in income.

Next, let’s net out 1.5 million units in home entertainment packaged media SKUs (across all three formats combined) and peg Netflix’s net for each unit sold at $15 (to take care of packaging, manufacturing, distribution and sales). That’s another $22.5 million tossed aside (is that too harsh? Perhaps “an unrealized revenue opportunity” would be more appropriate).

The exclusive Netflix streaming venue still remains for all those who didn’t go to the movies or buy a copy of the film, both of which are “windows” that Netflix controls. So, was it worth tossing a $70 million film into the streaming blender and kissing-off another $72.5 million in “opportunity revenue” just to generate Netflix views?

Did the arrival of Extraction 2 produce new subscribers? Were these new subs worth foregoing $72.5 million in net profits for Netflix?

Just an observation, nothing more.

Also getting a “helper” assist this past week as a newly-minted DVD edition was writer/director Bill Holderman’s Book Club: The Next Chapter, toplining Diane Keaton, Jane Fonda, Candice Bergen and Mary Steenburgen.

The film has generated $17.4 million in theatrical ticket sales to date and will be a future Universal Pictures Home Entertainment DVD and Blu-ray release, but the moment the VOD window kicked in the film became a “helper” target.

Also getting a Blu-ray assist from at least two “helper” sources is Vertical Entertainment’s 97 Minutes, directed by Timo Vuorensola and starring Alec Baldwin, MyAnna Buring and Jonathan Rhys Meyers.

In taking a look at year-to-date results (through 24 weeks) for both the DVD and Blu-ray formats, it is all-but-obvious that “helper”/”void-filler” attacks are running hot and heavy. We’ve just touched on the higher profile one, but the view out there is that all theatrical catalog releases from the 1930s, 40s, 50s, 60s, 70s and into the 1980s are now in the public domain — if rights’ holders don’t enforce their copyright protections that’s exactly what happens.

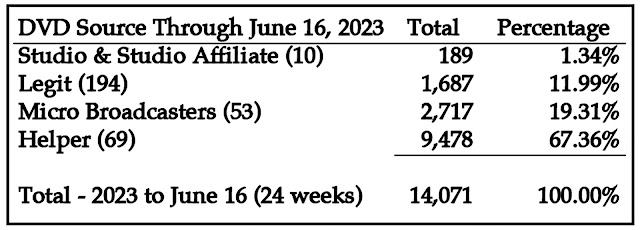

The DVD release pace is on a record-smashing pace through the first 24 weeks of the year (thru June 16), generating a preliminary SKU-count of 14,071 new DVD releases. That projects out to over 30,000 titles by year-end.

To date, the traditional “Hollywood” studies have all but checked out of the market with just a 1.34 percent share (189 combined DVD releases, including those from their affiliate sources).

Legit DVD release sources (tracking 194 so far in 2023) combined for 1,687 new DVD releases, or a SKU-count market share of 11.99 percent.

The home entertainment business and allied industry-watchers only recognize one in eight DVD arrivals at the consumer level. The rest — 86.77 percent of the release pie — are not on their radar.

Micro broadcasters (for lack of a better term), which are composed of local cable access and government broadcasters, generated 2,717 new DVD releases during the first 24 weeks of the year. That’s a 19.31 percent market share.

That local high school sporting event (lacrosse, baseball, softball, etc. etc.) is going to take place no matter what. A camera records the event, local volunteers or staff members call the play-by-play action and make it available as a DVD MOD (manufactured on demand) for a fee.

The same holds true for graduations, concerts in the park, parades … name a local activity and they are on it.

The three combined “legitimate” sources — studios, independent labels and micro broadcasters — own a 32.64 percent share of the release pie (one in three titles).

The rest of the action — so far this year — are from “helper”/”void-fillers” (we have discarded the terms pirates and bootleggers as being out of date). 9,478 different DVD titles (we are tracking 69 separate sources) from “helper” sources accounted for 67.36 percent of the pie (and that’s just 24 weeks into the year).

When you don’t enforce copyrights and focus entirely on streaming that’s what you get.

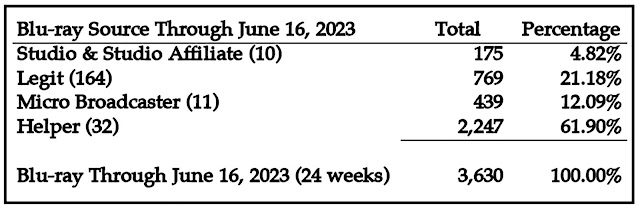

As for the Blu-ray format, we have recorded 3,630 new titles through June 16, which is also on a record pace (we could hit 8,000 by the end of the year).

Breaking this down, the studios have a 4.82 percent share (175 SKUs), the indie labels have a 21.18 percent cut of the pie (769 releases) and the micro broadcasters — tracking eleven different sources who have added Blu-ray on demand to their release mix — have a 12.09 percent cut in the action (439 titles).

If it streams, it will be stolen and released on Blu-ray, especially if it is an eight or ten-episode series (Blu-ray as a storage medium as opposed to use for HD quality). Thus far this year (and we are not quite at the halfway point) there have been 2,247 Blu-ray product offerings from “helper” sources (busy they are), which accounts for 61.90 percent of all releases.

We have a business (these days) where the power players take massive write-offs on streaming, neglect the theatrical marketplace and think that packaged media is all but dead. You have to read that business model as being both insane and out-of-touch.

No comments:

Post a Comment