Preliminary format release results for 2019 show

increases in SKU counts for both DVD and Blu-ray, while the 4K Ultra HD number

remained as nothing more than a studio high-profile theatrical release blip.

It should be noted that the DVD count will rise slightly

in the weeks ahead as stranglers are tracked down and posted. The Blu-ray number is pretty close to the

market and the 4K Ultra HD count is firm.

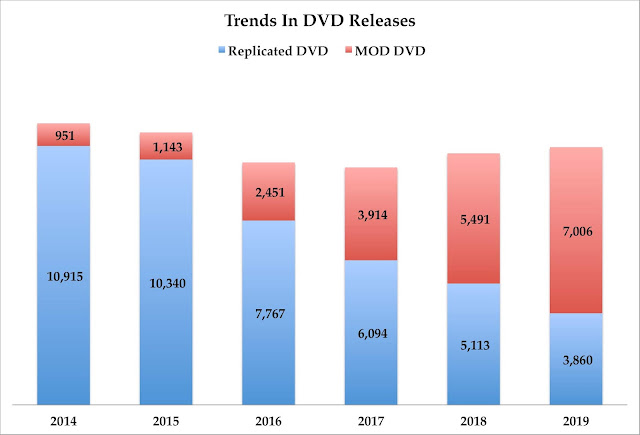

The DVD SKU count for 2019 currently stands at

10,866 new releases, that is a 2.47 percent increase over the 2018 posting of

10,604 new DVD titles. This rise in

output is generated by the ever-increasing use of on-demand publishing (MOD),

which now outpaces traditionally replicated discs by a factor of 64.5 percent

MOD to 35.5 percent replicated (7,006 titles versus 3,860).

The MOD/replicated ratio flipped in 2018 for the

first time when MOD releases outpaced traditionally replicated DVD product

offerings by 51.8 percent to 48.2 percent (5,491 versus 5,112).

We fully expect this trend to continue as MOD

publishing for DVD products will continue to mirror the book publishing

business for soft-cover books (especially from Amazon.com). 48-hour turn-around will become the norm for

the majority of titles released on DVD in the coming years … cheap, simple and

effective.

It is also a pirate’s paradise as the studios seem

content to let “deep catalog” offenses slide.

The big growth area for the DVD format is Sports

on-demand, with the CBS Sports Digital Network leading the way in publishing

high school sporting events nationwide on an on-demand basis. We expect this trend to include increases in

both college-level and professional sporting events in the near future.

Of note, Coplay, Pennsylvania’s Smart Mark Video

delivers a weekly slate of new DVD and Blu-ray on-demand releases to fans of

the professional wrestling market (non-WWE).

It would not come as a surprise if other niche sporting events were to

develop similar publishing venues … again, cheap, simple and effective.

Other on-demand categories that fuel the annual

count of DVD new product choices are Religion, Foreign Language movies and

Special Interest, plus recycled Theatrical library titles by “non-traditional”

sources, many of which are currently owned by the “Hollywood” studios (no one

seems to be monitoring this any longer).

It would not come as a surprise if the current

streaming wars ultimately became a rich source of programming for the on-demand

packaged media marketplace. Bloomberg reported this past week that a

whopping 535 new television programs were released in 2019 … that’s ten new

shows per week. Some on network, some

on cable and the bulk as streaming choices.

Just ball-parking the numbers, ten episodes per show, one hour per

episode … that’s something on the order of 5,000 hours annually of episodic

programming from just new productions alone.

Hello!!

Slow to pick up on the trend in on-demand publishing

is the music industry, which could be churning out “keep sake” editions of

concerts — both current and vintage — on an on-demand basis (someone will pick

up on this … of this we are sure). Fathom Events, with their rich selection of

operas and other musical events, while popular with theatre-goers, seem to have

missed this “keep sake” market as well (at least for the moment).

On the Blu-ray front, SKU count exceeded 3,000 new

releases for the first time in the history of the format this past year. The preliminary number stands at 3,027, an

increase of 7.53 percent over the 2018 Blu-ray release total of 2,815 new

titles.

The ratio between traditional replication and MOD

for the Blu-ray format remains remarkably stable — 71.5/28.5 percent in 2018

versus 71.1/28.9 percent in 2019 (Blu-ray is the workhorse for the studios at

this point, so that ratio should remain about same for 2020).

As for the 4K Ultra HD format, there were 170 new

product offerings in 2019 versus 179 in 2018 … that’s a decline of five

percent. Hardly worth noting!

Overall, combined new SKU counts for the three

formats currently stands at 14,063 for 2019 (that will continue to move upward

in the next few weeks as revisions are made).

Last year the number came home at 13,598, which marks an overall

increase of 3.4 percent in home entertainment packaged media output on a

year-over-year basis.

The overall ratio of traditional replication versus

MOD publishing — for the combined three formats — is now flipped in favor of

on-demand publishing for the first time.

56 percent of all new releases were on-demand (7,882), while 44 percent

were from traditional manufacturing (6,181) … the previous year (2018), the

on-demand percent was 46.3 percent (6,293), while traditional sources

contributed 53.7 percent (7,305).

The trend is unmistakable … it would not come as a

surprise if the overall record of 15,227 new releases achieved in 2006 is soon

eclipsed … on-demand publishing, coupled with new product sources will make

this so.

No comments:

Post a Comment